Deduction advice to supplier

Deduction advice to supplier document for manage deduction amount request against rejected materials purchased from supplier.

Deduction advice to supplier document is established to provides knowledge, request to suppliers to managing debit note / deduction amounts against rejected materials received from suppliers. The purchased all the materials customer is verified and inspection are conducted, and during the inspection or on before the material used in the processes in case any defects or mistake is identified that, customer is sending request note to supplier for the materials rejections, and sending deduction advice to supplier for credit amount against the rejected materials. Supplier’s concern peoples are verify the materials & if identify the advice claim is correct that as deduction advice, supplier is return amount to customers against rejected or defected materials. Deduction advice to supplier document managed by procurement management, the team is communicate with quality personnel to receiving results & outputs of quality inspection on purchased materials, on based of quality inspection and its test results, procurement department communicate with supplier, if the test are showing material defects or any other issues with purchased materials.

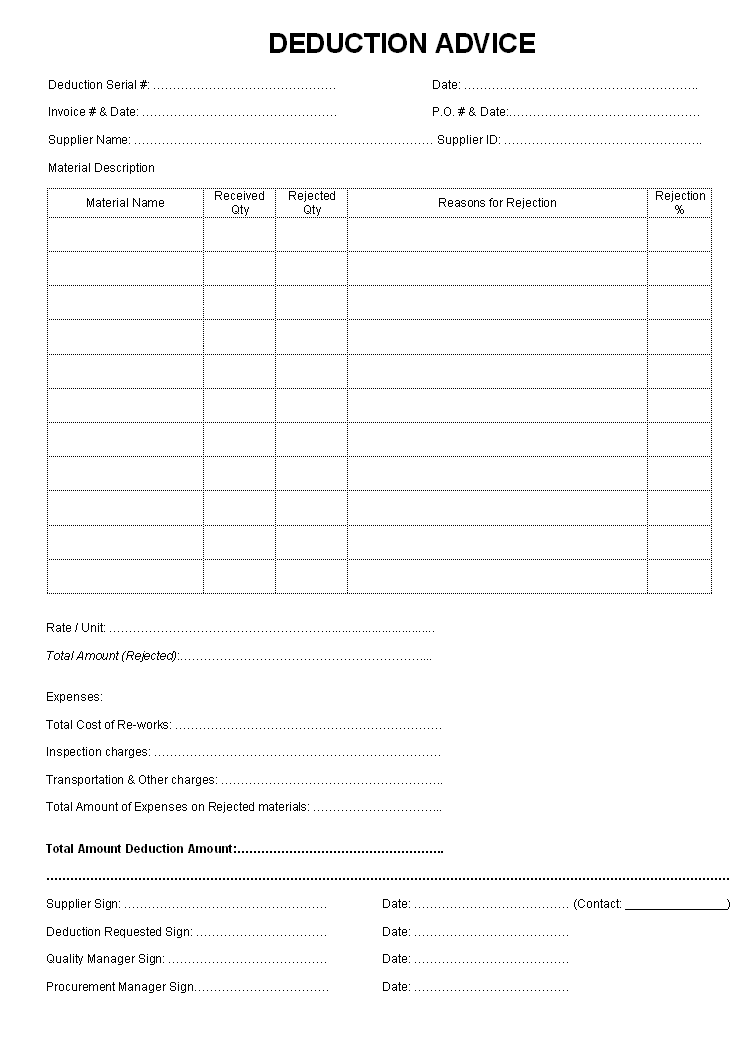

Deduction advice to supplier document established by procurement / purchase department of the organization, and procurement manager is responsible for conducting the procedures for returning materials, communicate with quality and supplier. When purchased materials are conducted for quality inspection or at in-process inspection any defects or materials having any issues are identified that rejected materials are returned to supplier by purchase department and sending deduction advice along with the materials to return or credit amount as mentioned in deduction advice, and the records are maintained and further corresponding maintained the same. See picture below given as example format of deduction advice for education purpose:

Deduction advice format is used to provide acknowledge and request format for return or credit amount against rejected materials as purchase order, and the format is used to advice the credit amount as mentioned, the format provides by procurement department to supplier on return materials. Deduction advice format copy and its concern documents are handled and storage by purchase department and its disposal process conducted as per documentation system.

—————————————————————————–

Download format in word document | Excel Sheet | PDF format

Deduction advice

—————————————————————————–